TEREVUE

Insurers are facing a data gap.

With natural disasters increasing in size, frequency and cost, typical insurance risk analysis can’t keep up, forcing insurers to abandon entire markets (and potential profits).

Look at risk through a new lens and thrive again in hazard-prone markets.

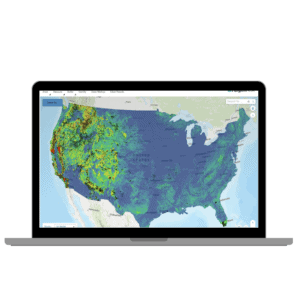

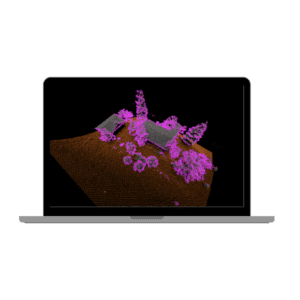

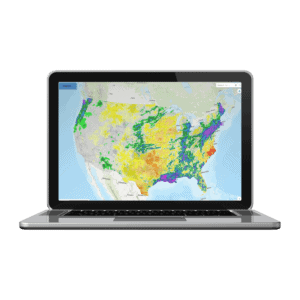

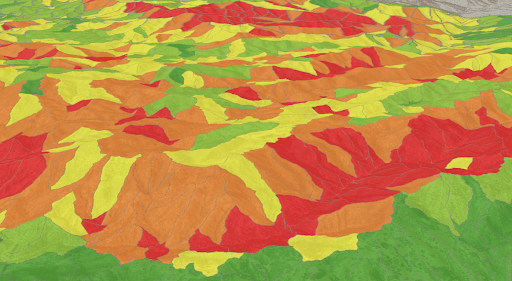

Teren’s suite of actionable wildfire, landslide, flood and weather data products help insurers quickly and accurately measure and monitor property-level risk conditions and make informed, confident decisions about which properties to insure.

.

– DATA PRODUCT SUITE –

Webinar: settling the score on wildfire risk

Teren and EigenRisk brought their expertise to the forefront, shedding light on the intricacies of wildfire risk assessment. Focusing on real-world scenarios, Teren and EigenRisk shed light on the intricacies of wildfire risk assessment for insurers.

RISK ANALYSIS, YOUR WAY

Teren provides customizable analysis and integrations to focus on the risk factors that matter most to you.

Insurance brokers

Get better evidence of property resilience to place customers with coverage in high-risk markets.

INSURANCE CARRIERS

Gain better insights into risk exposure and opportunities to improve customer resilience in high-risk markets.

Want to see Teren’s data product suite in action? Read these stories.

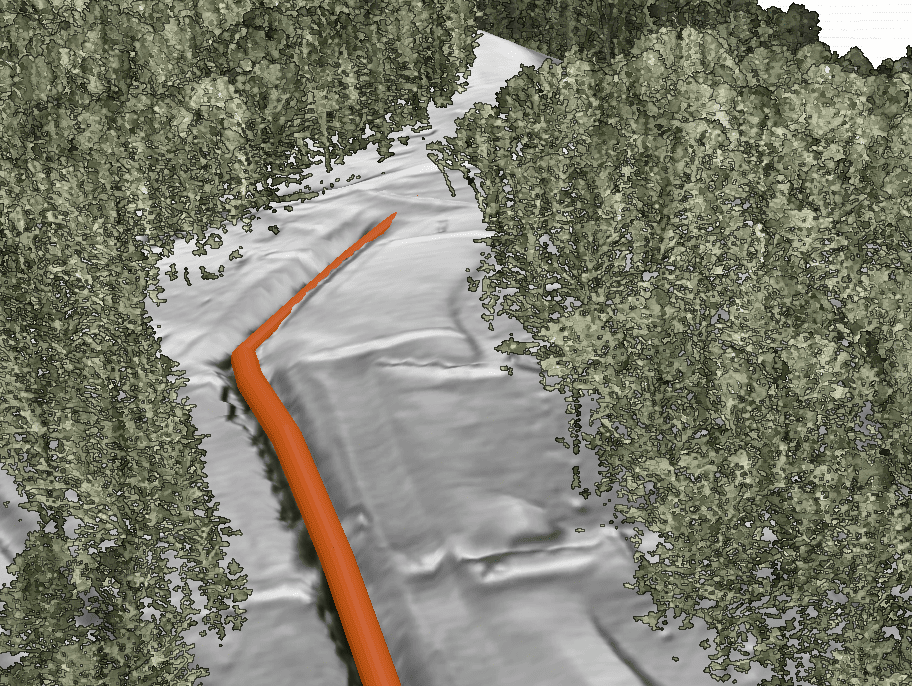

Revolutionizing Post-Wildfire Recovery: A Case Study on Hermits Peak Watershed Management Project

Read Teren's case study on the Hermits Peak watershed management project completed in collaboration with the USDA.

Nov

From Reactive to Proactive Pipeline Integrity Management: A Transformation in Appalachia

The Problem: A Hidden Threat to Critical Infrastructure Eight years ago, Bryan Crowe, a Pipeline Operations Manager, found himself in [...]

Sep

Teren Launches Hermit’s Peak Watershed Protection Analysis

Climate resilience analytics will offer actionable insights into Hermits Peak’s post-wildfire risks. Teren, the climate resilience analytics company, today launched [...]

Aug